March 18, 2024. 4 minute read.

By VV Sarah

Business Formation

DBA? LLC? Corporation? Partnership? You’re ready to start a new business, but you’re not sure what type of entity makes the most sense for you. We’ve assembled a quick pro-con comparison of all the options to help you choose the best entity type for you.

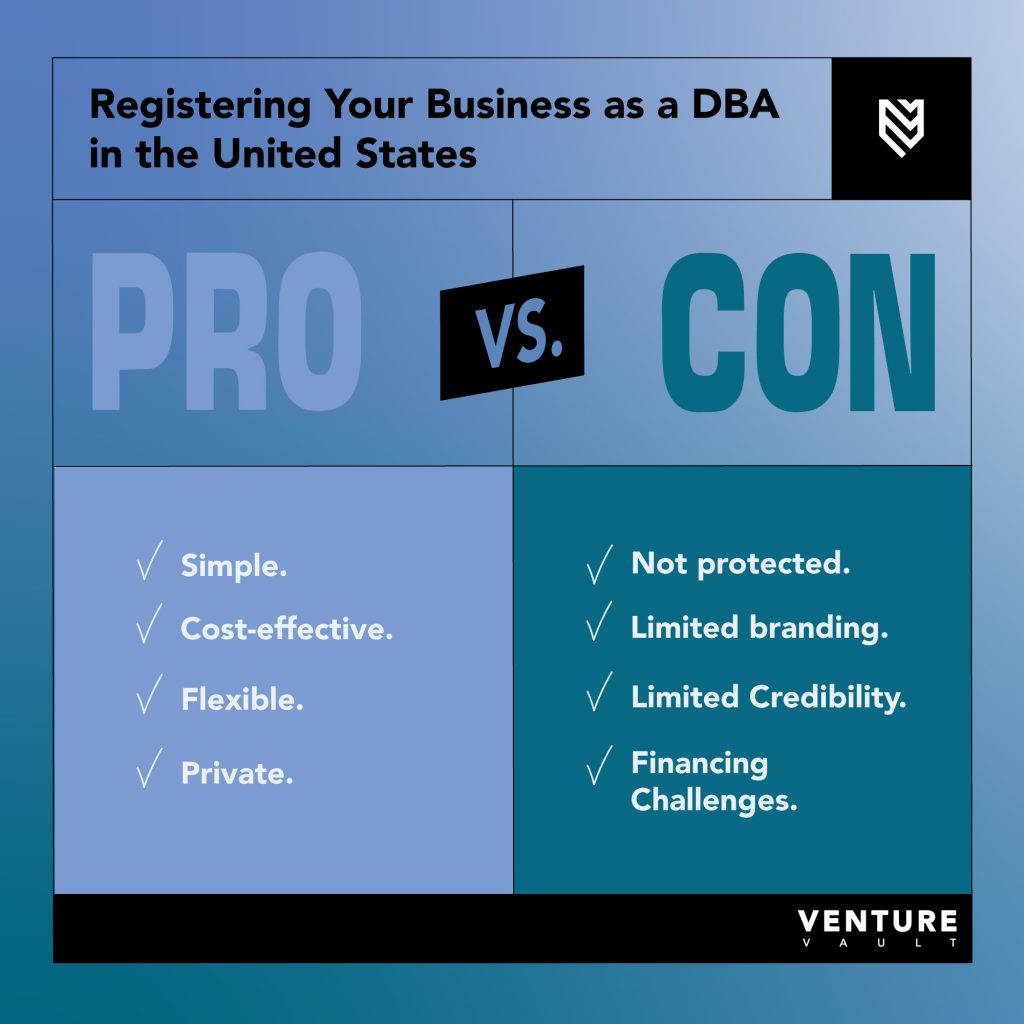

Here’s a pro/con comparison of keeping your business registered as a DBA (Doing Business As) compared to more formal filings such as Partnership, LLC, or Corporation:

DBA (Doing Business As)

Pros:

- Simple: Registering as a DBA is usually a straightforward process, requiring minimal paperwork and legal formalities.

- Cost-effective: The fees associated with registering a DBA are often lower compared to formal business entities.

- Flexible: DBAs allow for flexibility in terms of business structure and ownership arrangements.

- Private: Registering a DBA can help maintain some level of privacy since the legal name of the owner(s) is not publicly disclosed.

Cons:

- Not legally protected: A DBA does not offer the same level of legal protection as formal business entities. The owner’s personal assets are not separate from the business, which means they can be held liable for any debts or legal issues.

- Limited branding: A DBA does not provide exclusive rights to the business name, which means others can use the same or similar names, potentially causing brand confusion.

- Limited credibility: Some customers and partners may perceive a DBA as less credible or established compared to a formally registered entity.

- Financing challenges: DBAs may face difficulties in obtaining business loans or investment capital due to the perceived lack of legal structure and accountability.

Pros vs. Cons of Forming a DBA in the United States

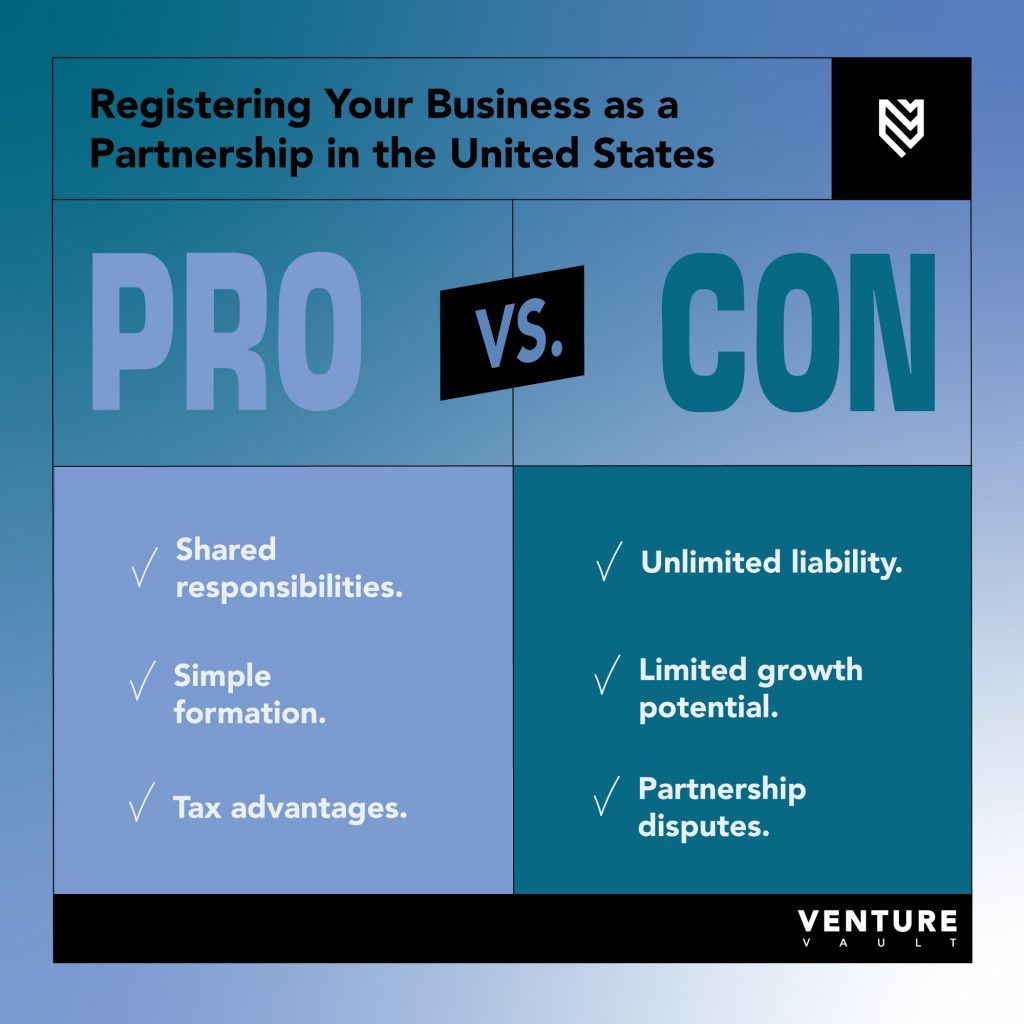

Partnership:

Pros:

- Shared responsibility: Partnerships allow for shared decision-making and shared responsibilities among partners.

- Simple formation: Setting up a partnership is relatively easy and requires fewer legal formalities compared to corporations.

- Tax advantages: Partnerships can offer tax advantages, such as pass-through taxation, where profits and losses flow through to partners’ individual tax returns.

Cons:

- Unlimited liability: In a general partnership, partners have unlimited personal liability for the business’s debts and legal obligations, which puts their personal assets at risk.

- Limited growth potential: Partnerships may face limitations in terms of attracting investors or raising capital compared to other entities like corporations.

- Partnership disputes: Disagreements between partners can lead to conflicts, which may disrupt business operations and strain relationships.

Pros Vs. Cons of Forming a partnership in the United States

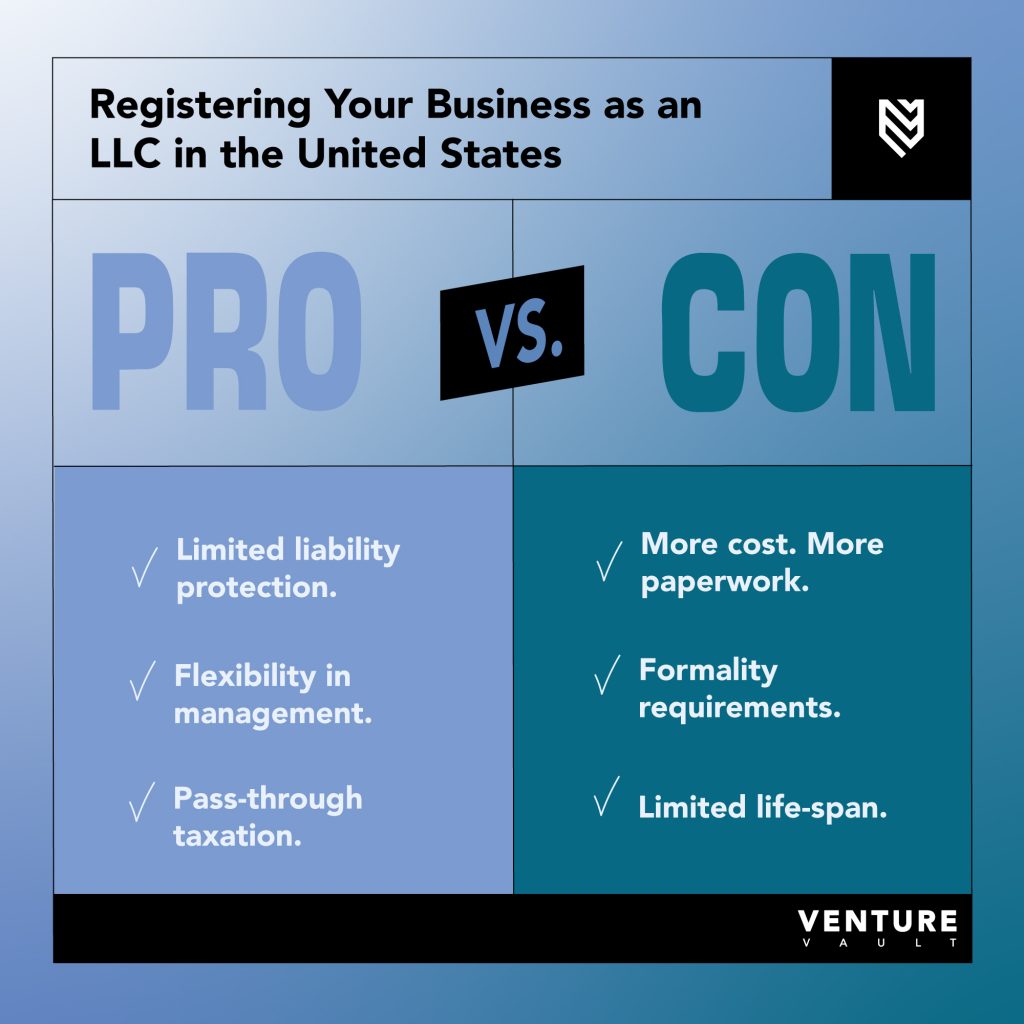

LLC (Limited Liability Company):

Pros:

- Limited liability protection: LLCs provide limited liability protection, separating personal assets from business debts and legal liabilities.

- Flexibility in management: LLCs can be managed by the owners (member-managed) or appoint managers (manager-managed), offering flexibility in decision-making and operations.

- Pass-through taxation: Like partnerships, LLCs can enjoy pass-through taxation, avoiding double taxation at both the corporate and individual levels.

Cons:

- Cost and paperwork: Compared to DBAs, forming and maintaining an LLC involves more paperwork and higher filing fees.

- Formality requirements: LLCs are subject to certain legal and administrative formalities, such as annual reports and maintaining proper records.

- Limited life span: In some jurisdictions, an LLC may have a limited life span, dissolving upon the departure or death of a member, unless specific provisions are made.

Pros Vs. Cons of Registering an LLC in the United States

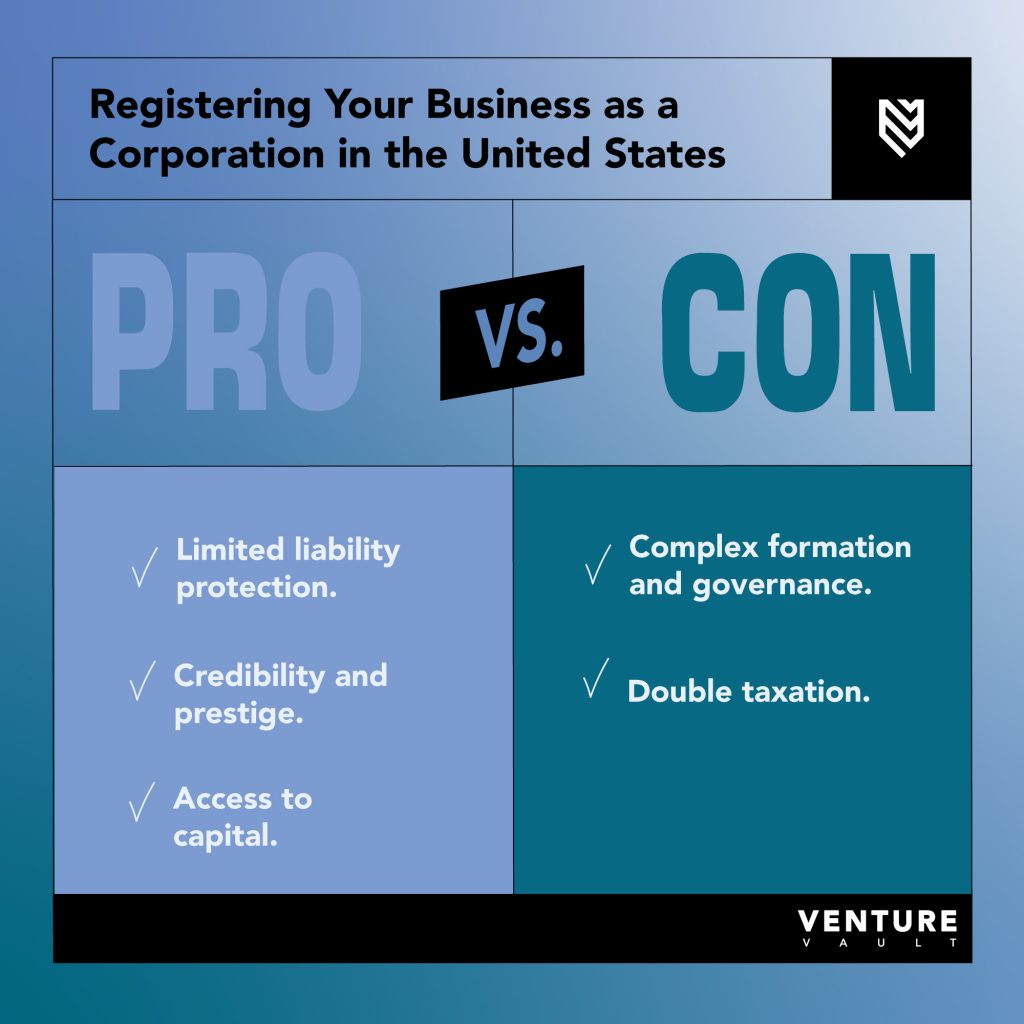

Corporation:

Pros:

- Limited liability protection: Shareholders in a corporation generally have limited liability, protecting their personal assets from the company’s debts and legal liabilities.

- Credibility and prestige: Corporations often carry more credibility and prestige in the business world, which can attract investors, partners, and customers.

- Access to capital: Corporations have better access to capital through the issuance of stocks and the ability to attract investors.

Cons:

- Complex formation and governance: Setting up and operating a corporation involves more complex legal and administrative processes, such as drafting bylaws, holding regular meetings, and maintaining detailed records.

- Double taxation: Corporations may face double

Pros Vs. Cons of registering your business as a corporation in the United States

Conclusion

As always, it is advisable to seek the counsel of a licensed attorney in registering your entity. The previous list is merely meant as a quick reference guide, and is not exhaustive or designed specifically for your business.